Here’s my January 2014 Denver Metro Market Watch so you know what’s going on. It was a wild year in 2013 and we saw record gains in home prices and days on market continues to decline. It started cooling off later in the year due to several factors. Rising interest rates, homes not appraising, and buyers choosing to avoid bidding wars. Many people also decided to stay put because while they wanted to move, they felt they could not find a replacement home they liked. I think 2014 will be a solid year. Home prices should slightly increase (not as fast as last year). The key factor: Many sellers were waiting for values to come back and now have some EQUITY. I believe many will decide this is the year to make a move since now they CAN! Here’s my market report for Jan 2014 for our Denver metro and Boulder county markets.

Here’s my January 2014 Denver Metro Market Watch so you know what’s going on. It was a wild year in 2013 and we saw record gains in home prices and days on market continues to decline. It started cooling off later in the year due to several factors. Rising interest rates, homes not appraising, and buyers choosing to avoid bidding wars. Many people also decided to stay put because while they wanted to move, they felt they could not find a replacement home they liked. I think 2014 will be a solid year. Home prices should slightly increase (not as fast as last year). The key factor: Many sellers were waiting for values to come back and now have some EQUITY. I believe many will decide this is the year to make a move since now they CAN! Here’s my market report for Jan 2014 for our Denver metro and Boulder county markets.

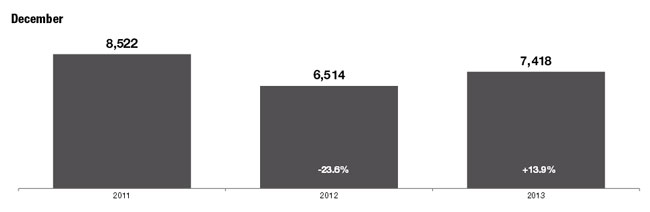

# HOMES FOR SALE (INVENTORY ) UP 13.9% FROM LAST YEAR 1(7,418 Homes For Sale Currently)

- WHAT’S TRENDING: Inventory trended upwards for the second half of 2013 but is still very low compared to the norm. 3,632 homes sold in December 2013 which means we about 2 months inventory right now.

- WHAT DOES THIS MEAN: Whenever inventory is below 4-5 months it favors sellers. The longer inventory stays low the more it weighs in their favor.

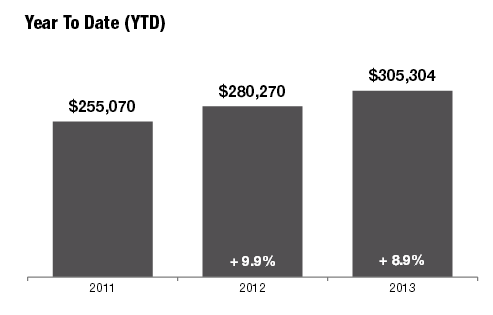

ANNUAL AVERAGE SOLD PRICE UP 8.9% FROM PRIOR YEAR

- WHATS TRENDING: Average sold price is $305,304. For some perspective, it was $275,000 in January 2013 and as high as $318,000 in June 2013.

- WHAT DOES THIS MEAN: The market is still correcting itself. Buyer’s are not bidding quite as high as we saw a few months ago and we have the typical slow down over the Holidays. A lot of closings in January 2014 were ones that contracted towards the end of 2013. It’s not a lot of “new business” from people starting their home purchase over Christmas etc. Prices are “normalizing” just a bit which is why they are coming down slightly. I personally don’t think this is a “bubble” and I think the price gains we had will maintain. A lot of economists I have been listening to feel similarly.

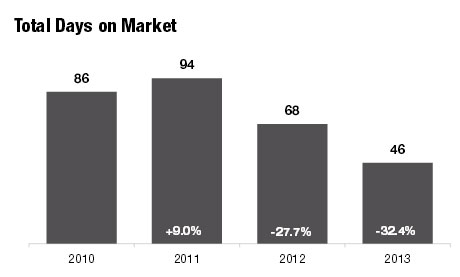

AVG DAYS ON MARKET CONTINUES TO DROP! NOW= 4 days (DOWN 32% FROM LAST YEAR)

New listings that are priced well are selling in about 7 days. Then the overpriced listings and short sales etc are taking 60+ days to close. If you are priced well it will sell quickly. If you are WAY over priced, however, buyers still aren’t pulling the trigger on yours. They have learned from the previous crash and don’t want to be “upside-down”.

New listings that are priced well are selling in about 7 days. Then the overpriced listings and short sales etc are taking 60+ days to close. If you are priced well it will sell quickly. If you are WAY over priced, however, buyers still aren’t pulling the trigger on yours. They have learned from the previous crash and don’t want to be “upside-down”.

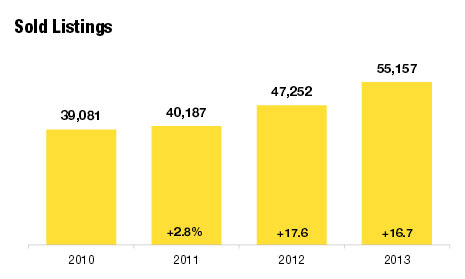

# SOLD HOMES UP 16.7% FROM LAST YEAR

- This is a big stat to watch. I mentioned in my last market update that this if this continues to drop fewer homes sell each month (if this trend continues), the more inventory we will have unless fewer sellers come ON the market. The more inventory we have, the less competitive it is for buyers, which means prices stop increasing. I will keep my eye on this as we move into the spring of 2014 but if you are thinking of selling this spring, let’s hope fewer sellers come on the market this fall to keep inventory around the current 2 month mark. If you are a buyer we hope this trend continues and there are even MORE homes for sale and fewer buyers to keep prices low. Personally, I think the first scenario is more likely and we will stay at about 2 1/2 months of inventory through early Spring. I think as more homes come on the market the seasonal buyer demand will pick up as well….keeping inventory levels about the same.

INTEREST RATES: In fall 2013 I wrote a post on how interest rates are impacting Colorado Real estate market. Well, the Federal Reserve has been announcing they WILL begin tapering off the purchase of mortgage backed securities….what this means is interest rates will rise through 2014. Most experts agree they will settle around 5% late this year and settle there for a while. I will keep my eye on this and report what I’m seeing in my next update.

Have a question about your neighborhood? Fill out this form and I will give you a shout right away!

Leave a Reply