The Making Home Affordable (MHA) program was introduced in 2009 to try and help stabilize the housing market by offering some … Continue reading...

Taylor Realty Group | Colorado Real Estate Experts

Taylor Realty Group | Colorado Real Estate Experts

Serving Denver Metro And Boulder County Since 2004!

The Making Home Affordable (MHA) program was introduced in 2009 to try and help stabilize the housing market by offering some … Continue reading...

Many people are facing foreclosure, foreclosed, or completed a foreclosure alternative such as a short sale. The big question is, … Continue reading...

When you apply for a mortgage, the lender has three days to give you a good-faith estimate of the fees and interest rate you’ll … Continue reading...

This keeps coming up in conversations I have with people so I want to address this new myth right now. NO. NO NO NO. You DON"T … Continue reading...

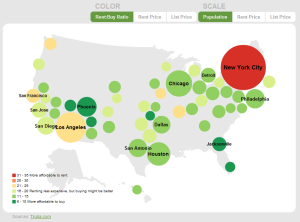

A report just came out from Trulia comparing the cost of renting vs owning a home throughout the US. For the Denver CO region, we … Continue reading...

Good news from Washington! FHA extended a temporary waiver of the agency's 'anti-flipping rule. The rule prohibits a buyer from … Continue reading...

A substantial number of people in Colorado (and the nation for that matter) have had a loss or decrease of income but would like … Continue reading...

Bank of America (BOA) announced they will resume foreclosures in Colorado very soon. They temporarily stopped foreclosures … Continue reading...

Well, our government is changing the fee structure for FHA loans effective this October. In my humble opinion, this is in response … Continue reading...

When a homebuyer wants to purchase a house in need of repairs or updating, he/she usually has to obtain financing first to … Continue reading...

1499 West 120th Ave #110 Westminster CO 80234

Colorado home buyers and sellers need a consultant, not a salesperson. I specialize in Broomfield, Thornton, & Westminster real estate but am often referred to help people throughout Denver Metro & Boulder County! My commitment to you: Expert Guidance & Friendly Personal Service!

Colorado home buyers and sellers need a consultant, not a salesperson. I specialize in Broomfield, Thornton, & Westminster real estate but am often referred to help people throughout Denver Metro & Boulder County! My commitment to you: Expert Guidance & Friendly Personal Service!