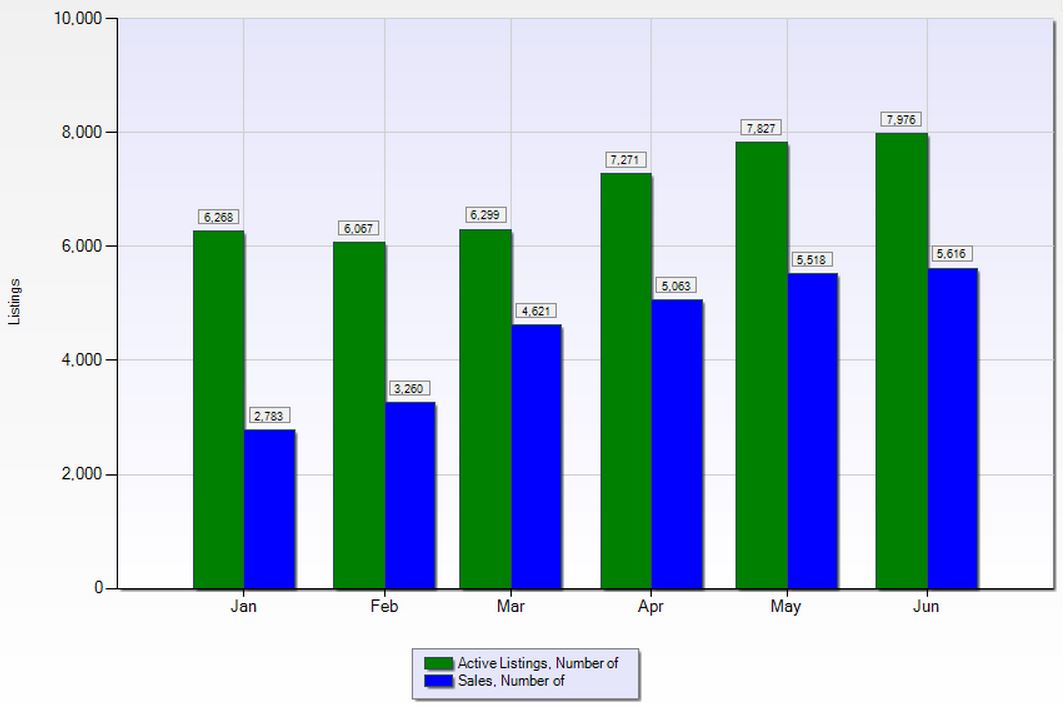

The number of homes for sale jumped as expected for spring but is not increasing as we hit the mid summer stride. This is a bit surprising but likely the rising prices where “would be sellers would move” are holding many back from listing. Competing against multiple offers for buyers remains the story for our Denver metro real estate market but it does FEEL that this is slowing but the days on market remains staggeringly low at only 6 days. Here are the highlights:

# HOMES FOR SALE (INVENTORY) ONLY UP 1.9 % FROM LAST MONTH (7,976 Homes For Sale Currently)

# SOLD HOMES NO CHANGE SINCE LAST MONTH (5,616 homes sold in June)

- WHAT’S TRENDING: Inventory jumped in April which was typical of the seasonal uptick….but now is staying constant from May to June. Buyers are still feeling pinched with limited options and multiple offers well over list price common but appraisals are starting to loosen up. This is making it easier for buyers when offering over list price, Seller rent-backs are still becoming more common as many sellers are shying away from contingencies.

- WHAT DOES THIS MEAN: Whenever inventory is below 4-5 months it favors sellers. Right now we have about 1.5 months of inventory. The longer inventory stays low the more it weighs in the seller’s favor. Buyers need to act quickly when they find a home they like and make an aggressive offer. Coming in way under list price expecting a counter is not a prudent strategy and is resulting in getting outbid by other buyers. Sellers need to have a strong pricing & marketing strategy to get the MAXIMUM price & buyer interest immediately when coming on the market. Even more importantly, your listing agent needs to help you work with the appraiser to try and get an appraisal that supports what a buyer is willing to pay. Appraisers are still going on historical data and have a tough time accounting for the premiums buyers are willing to pay in the low-inventory market.

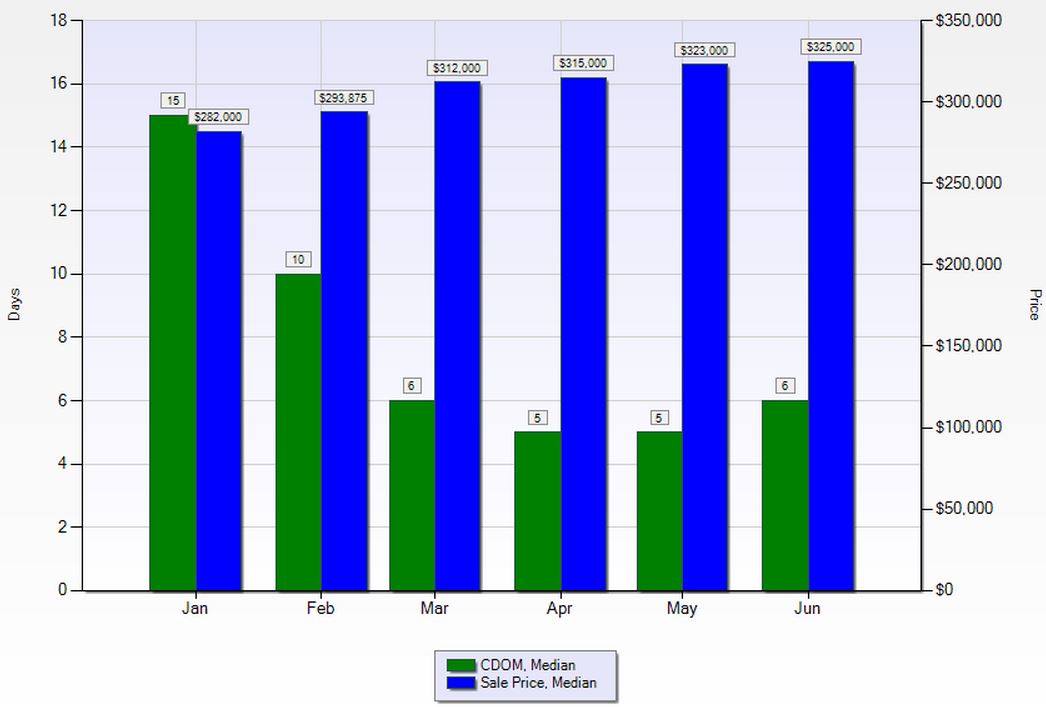

MEDIAN DAYS ON MARKET INCREASES SLIGHTLY….RISEN FROM 5 DAYS TO 6

This is an interesting stat. While it only rose 1 day, a 1 day increase from 5 days is 20%. This is one to watch closely and if this trend continues for July, I expect to see inventory rise as well…which will slow the price growth even further.

- WHATS TRENDING: Median sold price is $325,000 but is only up $2,000 from last month. Barely enough to register a % change.

- WHAT DOES THIS MEAN: People keep asking me “is this a bubble. My response: until inventory gains over take the # of homes sold, no. And once this does happen…due to population growth projections and rising rental rates, the values will hold as demand stays steady for home purchases. We eventually will see a slow down in price increases but I highly doubt we will see a decline. Many industry experts feel similarly. The challenge this presents is mostly for appraisals. They are based on “HISTORIC” data while buyers are making offers based on present demand and inventory levels. Some homes are not appraising for what buyers are willing to pay.

Leave a Reply