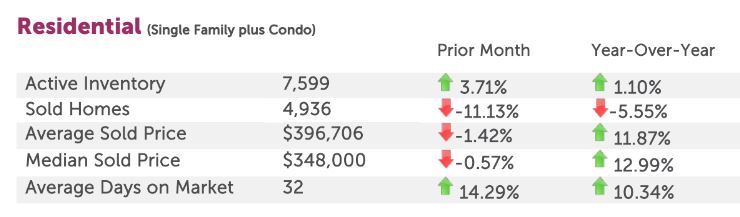

Our Denver Metro market has been a pressure cooker for buyers. Some are calling it a bubble that is about to pop! Will it? Here’s what you need to know from someone on front lines. Here ya go with current stats…and below we’ll break them down to come to an honest conclusion.

The time it takes to sell a home has risen sharply…it was 5 days back in April 2016 and is now 32 Days!!

This is a big change but is a good one. Many would be sellers were hesitant to list their home as they were worried they could not find a home as quickly as they would need…and end up “homeless”. Hence, our inventory remained low because these types of folks did not put their home on the market. It was almost a self fulfilling prophesy if you will.

Mike’s Take:

With the current Days on Market rising to 32 days, I don’t believe this is alarming. I feel this is a normal seasonal adjustment as kids go back to school and homes take longer to sell. Combine this with “buyer burnout” from the summer, this was to be expected. The key factor is INVENTORY not days on market. Keep reading below….

# Homes For Sale Is SAFELY rising – still only have 1.5 Months of Inventory

This past spring and summer of 2016, demand was much larger than the home supply and dropped the # of homes for sale to record lows. This was a pressure cooker for buyers. Prices rose sharply, many buyers clawed and scratched to outbid each other, and sellers were amazed at the prices they sold for.

Mike’s Take:

Prices always rise until supply is more “normal” which is about 3-4 months inventory for a real estate market. Right now we have 1.5 months of inventory but it’s continuing to rise. This is actually a GOOD thing for our market. If it continued, the theorized “bubble” would be at greater risk of popping. The numbers show the year over year change is only 1% in # of homes for sale (active inventory).

# Sold Homes Is DOWN 5% From Last Year

This is a big stat to keep an eye on. I’m not too concerned about the drop off from last month (-11%) as this is a typical seasonal slowdown. But..I would hope and expect the # of homes sold to increase from last year….but instead it’s dropped.

Average Sales Price Is Up 11% From Last Year But Prices Are Stabilizing (Not rising like crazy anymore)

This is an even bigger stat to be aware of but is a GOOD thing. Housing bubbles happen when prices get out of control and are over inflated. Seeing price growth slow and even correct slightly (-1% from last month) is a good thing.

Mike’s Take:

I believe the buyer demand slowing slightly has led to buyers not driving the market up like they were. Again, this is a good thing as the price growth we were seeing was not sustainable over a long period of time.

CONCLUSION – SO IS THIS A BUBBLE OR NOT AND WILL IT BURST?

Since we can see the # of homes for sale isn’t substantially higher (only 1%) than a year ago, then the market slowing is NOT due to more sellers selling, but instead, fewer buyers buying. The demand has dropped off. Last time we had a “bubble burst” the supply rose sharply and flooded the market with more and more sellers wanting (or needing) to sell along with new home builders selling off the surplus of completed homes at a deep discount. So, relax folks….the # of homes for sale is only 1% greater than last year and is only 7,599 homes currently. Back in the “olden days” of the last market crash, the # of homes for sale was around 30,000!! In my opinion, we are definitely not seeing a bubble at this time. Could things change…sure…change and death are the only guarantees…but right now this is NOT a bubble. The growth is sustainable for now. I will keep my finger on the market for you…

Have a real estate question? Fill out this form and I will give you a shout right away!

Hi Mike, it appears that this article is at least severaL years old…? What is your take on the current situation?